The Indian stock market is a dynamic platform where retail and institutional investors actively participate to grow their wealth. Among the plethora of trading instruments available, options trading stands out for its flexibility and potential for high returns. Whether you are a beginner or an experienced trader, understanding effective Option trading strategies for the Indian stock market can significantly enhance your profitability.

In this blog, we’ll dive deeper into option trading strategies for the Indian stock market, exploring their use cases and how to optimize your trades for maximum returns.

What is Options Trading?

Options are derivative instruments that provide traders the right, but not the obligation, to buy (call options) or sell (put options) an underlying asset at a predetermined price before a specific expiration date.

This versatility allows traders to hedge risks, generate income, or capitalize on market volatility.

Top Option Trading Strategies for Indian Investors

- Covered Call Strategy

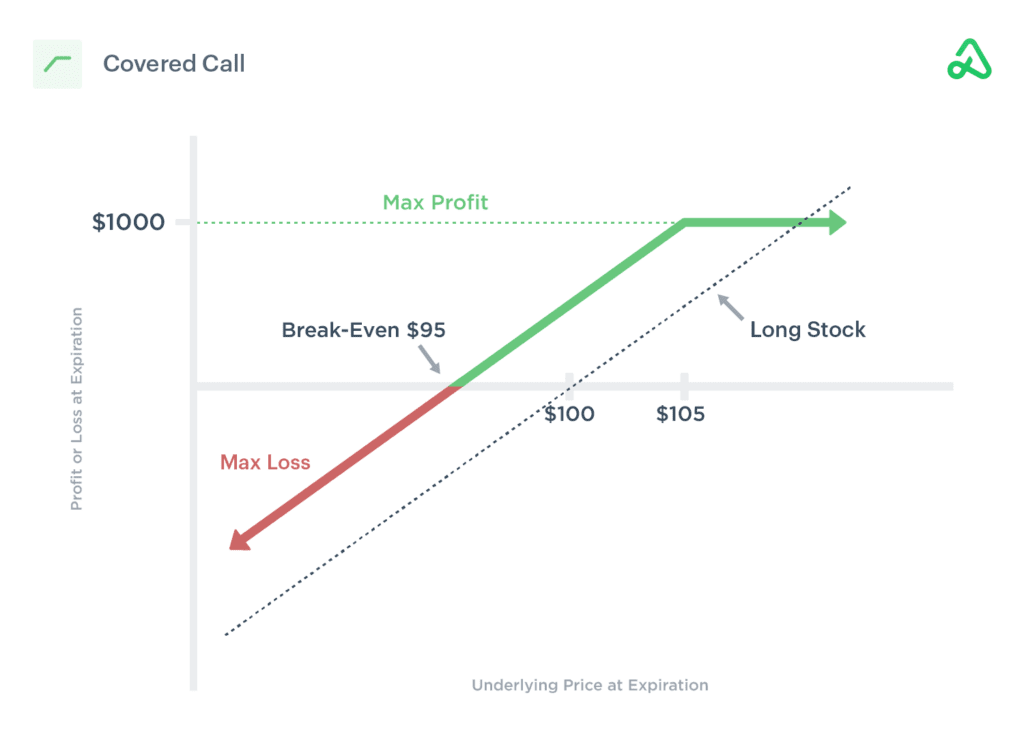

A covered call involves holding a stock and simultaneously selling a call option. This strategy works best in a sideways market where the stock price is expected to remain stable or slightly bullish.

Example: Suppose you own shares of Reliance Industries, trading at ₹2,500. You can sell a call option at a strike price of ₹2,600 to earn a premium while retaining ownership of the stock.

When to Use:

You have a neutral to moderately bullish outlook.

You aim to generate income through premiums while holding the stock. - Protective Put

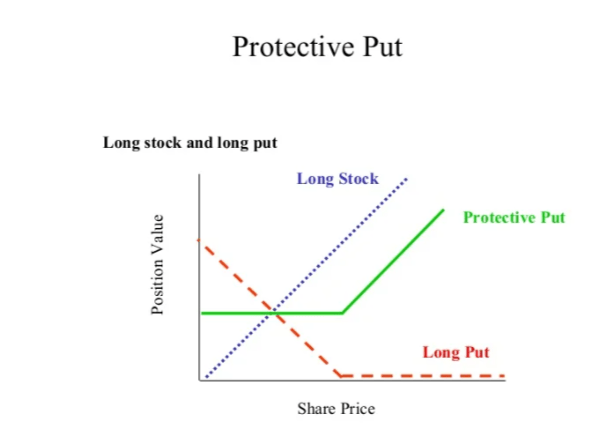

A protective put involves purchasing a put option to hedge against potential losses in your stock holdings. It acts as insurance by limiting downside risk.

Example: If you own Tata Steel shares at ₹800, buying a put option at ₹750 ensures that your maximum loss is limited to ₹50 per share, irrespective of further market declines.

When to Use:

You are bullish on a stock but want to protect against unexpected downturns.

During periods of heightened market volatility. - Bull Call Spread

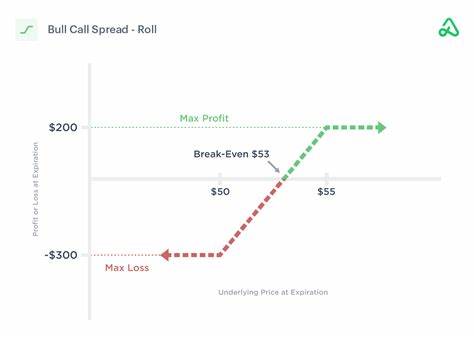

This is a debit strategy that involves buying a call option at a lower strike price while selling a call option at a higher strike price, both with the same expiration date.

Example: Buy a Nifty 50 call option at 19,600 and sell a call option at 19,800. This strategy limits risk while providing moderate upside potential.

When to Use:

You expect the market to rise moderately.

You seek to reduce the cost of the call option. - Bear Put Spread

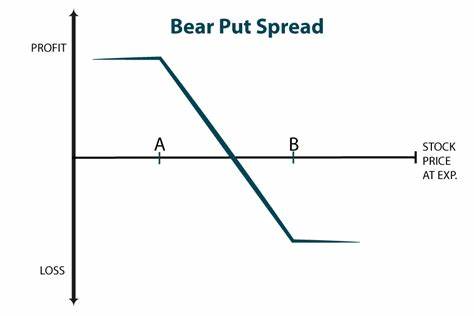

A bear put spread is a debit strategy similar to the bull call spread but designed for bearish markets. It involves buying a put option at a higher strike price and selling a put option at a lower strike price.

Example: Buy a Bank Nifty put option at 45,000 and sell a put option at 44,800. This reduces the upfront premium while capping potential profits.

When to Use:

You anticipate a moderate decline in the market.

To hedge against a potential downturn at a reduced cost. - Iron Condor

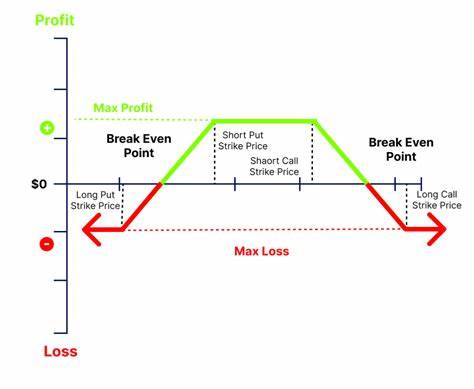

The iron condor is a non-directional strategy that works best in a low-volatility market. It involves selling an out-of-the-money call and put, while simultaneously buying further out-of-the-money call and put options.

Example: Sell a call option at 19,700 and a put option at 19,300, while buying a call option at 19,800 and a put option at 19,200.

When to Use:

When the market is range-bound with low volatility.

To capitalize on time decay (theta). - Straddle

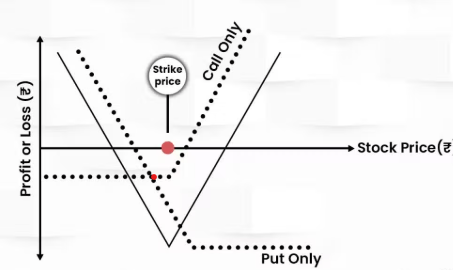

A straddle involves buying both a call and put option at the same strike price and expiration date. This strategy profits from significant market movement in either direction.

Example: If Infosys is trading at ₹1,450, buying a call and put option at this strike price lets you gain from sharp moves due to an earnings announcement or other events.

When to Use:

Before major events like earnings reports or budget announcements.

In highly volatile markets. - Calendar Spread

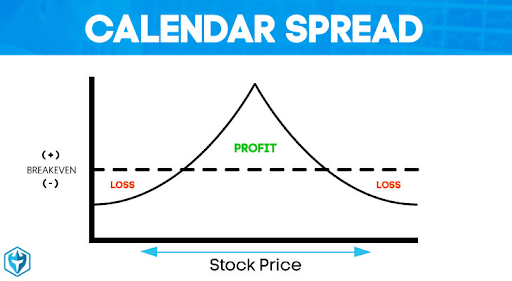

A calendar spread involves selling a near-month option and buying a far-month option of the same strike price. This strategy benefits from time decay of the near-term option while retaining exposure to long-term movements.

Example: Sell an Nifty call expiring this month and buy the same strike call expiring next month.

When to Use:

When volatility is expected to increase in the long term.

To capitalize on time decay differences.

Risk Management in Options Trading

Position Sizing: Never risk more than a small percentage of your total capital on a single trade.

Diversification: Avoid overexposure to a single sector or stock.

Use Stop-Losses: Protect against significant losses by setting predefined exit points.

Stay Updated: Monitor macroeconomic indicators, company performance, and market trends regularly.

Tools and Resources for Indian Traders

StockEdge and Moneycontrol: For news and insights.

NSE Option Chain: To track live option prices.

TradingView: For technical analysis and charting

Stock market investing in 2025 offers a wealth of opportunities for wealth creation and financial growth. From traditional investments like PPF and SSY for stability to Systematic Investment Plans (SIPs) for disciplined savings, there’s something for every investor. For those looking to diversify, cryptocurrency trading and real estate provide options to balance risk and return. Meanwhile, green Investing and sustainable investing are gaining traction, allowing investors to support eco-friendly initiatives.

For beginners, comparing ELSS vs. PPF and Mutual Funds vs. Stocks can clarify tax-saving and investment options. Advanced strategies like option trading and dividend investing cater to seasoned investors seeking passive income. Leveraging AI investment tools and staying updated on the top stocks to pick can simplify decision-making and maximize returns.

Whether you’re comparing real estate vs. stock market or exploring digital payments for SIPs, the key is to align your choices with your goals. Focus on long-term investments through top mutual funds, sustainable stocks, or mastering options trading for consistent success. With the right mix of strategy, research, and modern tools, achieving stock market success and financial freedom has never been more attainable. Choose wisely and invest in your future!